Definition

What is an AIF (Alternative Investment Fund)?

Alternative Investment Funds (AIFs) are pooled investment vehicles that channel capital into a diverse range of alternative asset classes. Unlike conventional investment avenues such as equities or debt instruments, AIFs invest in areas like private equity, venture capital, real estate, hedge funds, and managed futures. They serve as a unique platform for high-net-worth and sophisticated investors seeking to diversify their portfolios and explore unconventional investment opportunities. Secure your AIF registration license efficiently and in full compliance with regulatory requirements, with expert assistance ensuring a smooth and seamless application process.

Alternative Investment Funds (AIFs) are governed and regulated by the Securities and Exchange Board of India (SEBI) under the SEBI (Alternative Investment Funds) Regulations, 2012. Unlike mutual funds, AIFs are not covered under the Mutual Fund Regulations framed by SEBI.

According to Regulation 2(1)(b) of the SEBI (Alternative Investment Funds) Regulations, 2012, an AIF refers to any fund established or incorporated in India as a trust, company, limited liability partnership (LLP), or body corporate. It functions as a privately pooled investment vehicle that collects funds from investors—whether Indian or foreign—for investment in accordance with a defined investment policy, with the objective of generating returns for its investors.

These funds are professionally managed and can be structured as a trust, company, LLP, or body corporate, in compliance with the applicable legal and regulatory framework.

AIFs are private pooled investment funds and are not available through the forms of public issues (like Initial Public Offerings), which apply to Mutual Funds or other collective investment Schemes.

Generally, high net worth individuals and institutions invest in AIFs Alternative Investment Funds, as they require a high investment amount, unlike Mutual Funds.

As per the AIF Regulation 2012, an AIF is a fund established in India, whether as a Trust or a Company, or an LLP, which is :

Which entities are exempted from the purview of AIF Regulations?

Entities that do not fall under the purview of AIF Regulations

The landscape of financial regulations in India is broad and complex, with various entities operating within specific regulatory frameworks. One such entity is the Alternative Investment Fund (AIF), which is defined and regulated under the SEBI (Alternative Investment Funds registration) Regulations, 2012. As part of these regulations, certain entities are explicitly excluded from being classified as AIFs, and others are granted specific exemptions. Understanding these exceptions is crucial for businesses and individuals who are exploring investment opportunities or considering establishing an AIF. The following discussion provides an elaboration on these entities.

-

Entities covered under other SEBI regulations: AIFs do not include funds that fall under other specific SEBI regulations, namely:

-

SEBI (Mutual Funds) Regulations, 1996: Mutual funds are a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which are managed by an investment company. Mutual funds are covered under their own specific regulations and are not considered AIFs.

-

SEBI (Collective Investment Schemes) Regulations, 1999: Collective Investment Schemes (CIS) are also a type of investment vehicle where funds are pooled from various investors to invest in a portfolio of securities. Like mutual funds, CISs are governed under their own regulations and are excluded from being classified as AIFs.

-

Other SEBI regulations for fund management activities: Other SEBI regulations govern specific types of fund management activities. Funds that are covered under these regulations are also not considered AIFs.

-

Exemptions from AIF Registration: Certain entities are granted exemptions from registration under the AIF regulations. These include:

-

Family trusts for the benefit of 'relatives': Family trusts that are set up for the benefit of 'relatives', as defined under the Companies Act, 1956, are exempted from AIF registration. This means that these trusts can operate without having to comply with the AIF regulations.

-

Employee welfare or gratuity trusts: Trusts that are set up for the benefit of employees, including employee welfare trusts and gratuity trusts, are also exempted from AIF registration. These trusts are typically established by companies to provide benefits to their employees.

-

Holding companies: Holding companies, as defined under Section 4 of the Companies Act, 1956, are another category of entities that are exempted from AIF registration. A holding company is a company that owns the stocks of other companies, to control the management and policies of the companies it owns.

It's important to note that while these exemptions exist, the applicability of these exemptions depends on the specific circumstances and legal interpretations. Therefore, potential investors and fund managers should seek professional legal and financial advice to understand how these regulations may apply to their specific situations.

What are the benefits of an AIF?

Following are the benefits of Alternative Investment Funds:

-

Greater Flexibility and Scope: AIFs offer greater flexibility and scope compared to traditional investment options. They are not bound by the same kind of investment restrictions that apply to mutual funds, for instance. This means that AIFs can invest in a broad range of assets and adopt innovative investment strategies, offering a variety of options for investors seeking different risk and return profiles.

-

Lucrative Risk-Return Ratio: With the potential for high returns comes higher risk, but many investors find the risk-return ratio offered by AIFs to be very attractive. The ability to invest in non-traditional and less liquid assets, such as private companies or commodities, means that AIFs can potentially offer higher returns than traditional investments.

-

Greater Diversification and Low Correlation: AIFs can invest in a wide array of assets that are not typically included in traditional portfolios, providing a valuable tool for portfolio diversification. Additionally, the returns from these alternative investments often have low correlation with traditional asset classes, which can help reduce portfolio volatility and enhance risk-adjusted returns.

-

Opportunities in Unlisted Companies and High-Yielding Funds: AIFs often provide opportunities to invest in unlisted companies and other high-yielding funds, which are typically inaccessible to regular investors. This gives investors access to potentially lucrative investment opportunities in the private sector, such as early-stage startups, real estate projects, or distressed assets.

-

Structured Products with Ample Risk Mitigation: AIFs often offer structured products that are designed to provide a certain level of risk mitigation, while still offering the potential for substantial returns. These structured products use sophisticated investment strategies and financial instruments to balance risk and return. This makes AIFs particularly attractive to high-net-worth individuals (HNIs) who are seeking diversified exposure to alternative investments while also managing their overall portfolio risk.

Remember, while these benefits can make AIFs a valuable component of a well-diversified portfolio, they also carry risks. As such, investors should thoroughly understand these risks and consult with financial advisors before investing.

How does an AIF obtain a registration certificate?

Conditions for grant of AIF Registration Certificate

The conditions for grant of certificate of registration in accordance with Section 6 of the Alternative Investment Fund Regulations are stated as follows:

- Alternative Investment Funds shall have to mandatorily comply with all the conditions of the respective Regulation;

- Alternative Investment Funds shall not perform any kind of operations which are not regulated by the act;

- Alternative Investment Fund shall keep SEBI apprised of any situations or activities which involve the submission of falsified documents or any other occurrence of non-compliance with the provisions of the SEBI Regulations;

- The applicant should have restrictions to accept deposits in its Memorandum of Associations & Articles of Association.

- Maximum number of investors shall be limited to 1000 persons.

What are the pre-requisites for setting up an AIF?

Prerequisites for registration of AIF Registration || Legal Requirement for AIF Registration

A. Charter document like MOA or Trust Deed or Partnership Deed shall have clauses pertaining to carrying on the activity as an Alternative Investment Fund

B. In case of a trust or partnership firm, the respective Trust Deed or Partnership Deed shall be registered with the respective registrar in accordance with the applicable laws

C. The charter document shall contain provisions prohibiting an invitation to the public to subscribe to its securities

D. The Applicant, Sponsor and Manager shall be “fit and proper” as prescribed in Schedule II of the Securities and Exchange Board of India (Intermediaries) Regulations, 2008

E. At least one key personnel among those functioning in the key investment team of the Manager of an AIF must obtain certification by passing the NISM Series-XIX-C: Alternative Investment Fund Managers Certification Examination.

F. Manager & Sponsor of an AIF shall possess the necessary infrastructure and manpower to discharge its activities

G. The Applicant shall clearly describe the objectives of investment, the strategy of investment, proposed corpus of the Fund, its tenure and targeted investors.

H. An AIF should have a minimum corpus of at least Rs. 20 crores (For an Angel Fund, the minimum corpus has been placed at INR 5 crores)

I. The minimum amount of investment to be brought in by every investor in an Alternative Investment Fund should be INR 1 crore. However, the minimum investment by an investor is prescribed at INR 25 lakhs for Angel Fund.

G. The minimum investment by an employee or director of the Manager of an Alternative Investment Fund shall be INR 25 lakhs or more.

H. It is not mandatory for an employee of the Manager who is participating in the profits to make any investments in the AIF

I. An AIF scheme cannot have more than 1000 investors whereas an Angel Fund cannot have more than 200 investors

J. Category I and Category II Alternative Investment Funds are close-ended funds, whereas category III Alternative Investment Funds are open-ended Funds

K. The minimum tenure for Category I and Category II AIF is 3 years whereas for ANGEL FUNDS the maximum tenure 5 years. There is however a provision for extension of tenure of an AIF which requires the approval of the Unit Holders comprising of at least 2/3rd in value corpus.

L. AIF Regulations restrict solicitation or collection of funds by category 3 AIF, except by way of private placement in accordance with the provision of the Companies Act, 2013 as there is no specific provision for the same in AIF Regulations

M. Units of an Alternative Investment Fund may be listed on stock exchange only after final closure of the fund or scheme, subject to minimum tradable lots of INR 1 crore.

How do the various categories of AIFs differ from one another?

Comparitive Analysis of Categories Alternative Investment Funds | AIF

Following is a Detailed categorisation and analysis of different categories of Alternative Investment Funds

| |

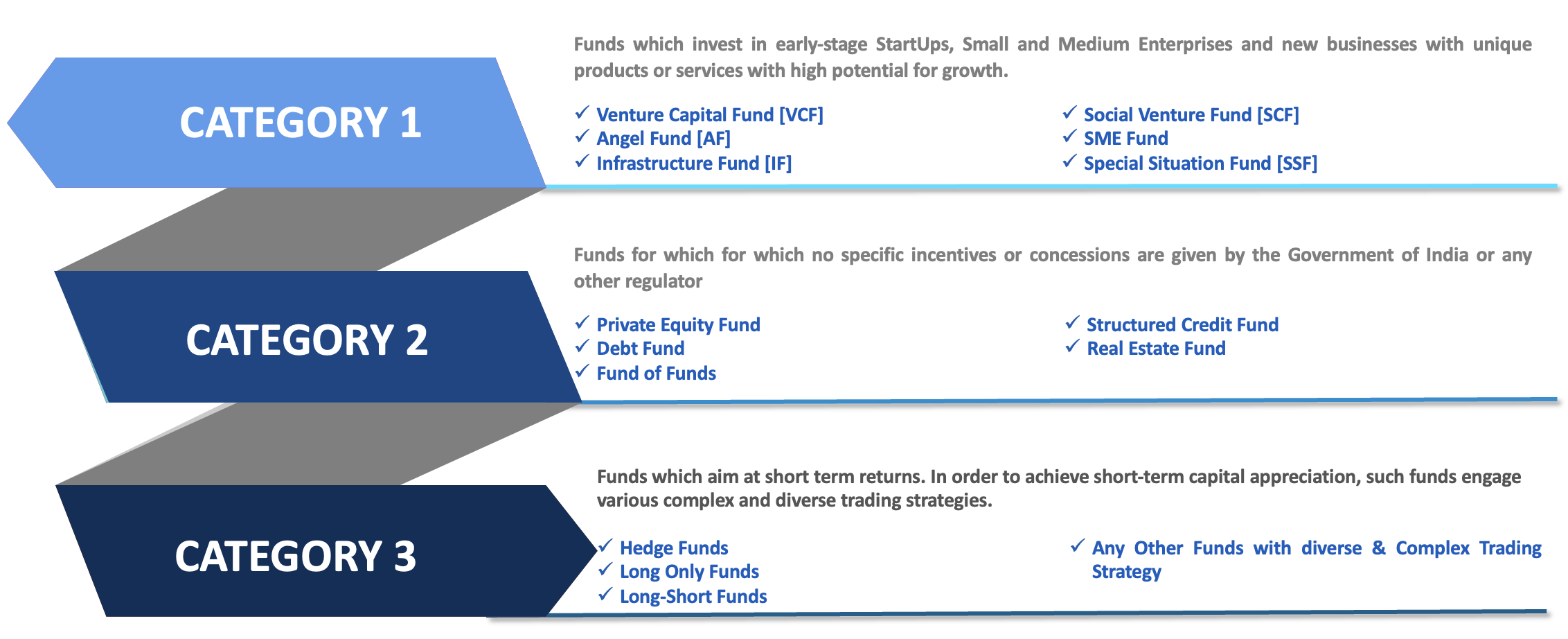

CATEGORY 1 (AIF)

|

CATEGORY 2 (AIF)

|

CATEGORY 3 (AIF)

|

|

Sub-Categories

|

- Venture Capital Fund [VCF]

- Angel Fund [AF]

- Infrastructure Fund [IF]

- Social Venture Fund [SCF]

- SME Fund

- Special Situation Funds [SSF]

(SSF's retricted to invest only in stressed asset)

|

- Private Equity Fund

- Debt Fund

- Fund of Funds

- Structured Credit Fund

- Real Estate Fund

|

- Hedge Funds

- Long Only Funds

- Long-Short Funds

- Any Other Funds with diverse & Complex Trading Strategy

- Private Investment in Public Equity [PIPE]

|

|

Registration Fees

|

INR 500000

(INR 200000 for Angel Funds)

|

INR 1000000

|

INR 1500000

|

|

Managers Contribution

|

> 2.5 % of the corpus of the Fund; OR

> INR 5 Crores (INR 50 Lakhs for Angel Funds)

Whichever is LOWER

|

> 2.5 % of the corpus of the Fund; OR

> INR 5 Crores

Whichever is LOWER

|

> 5 % of the corpus of the Fund; OR

> INR 10 Crores

Whichever is LOWER

|

|

Minimum Corpus required for each scheme

|

Minimum Corpus of INR 20 Crores

[INR 5 Crores in case of Angel Funds &

INR 100 Crores in case of SSF's]

|

Minimum Corpus of INR 20 Crores

|

Minimum Corpus of INR 20 Crores |

|

Thresholds for investment in Listed Securities

|

Limited investments permitted in Listed Securities.

Differs for different subcategories

|

Upto 49.99% of the corpus can be invested in listed securities

|

Upto 100% of the corpus is permitted to be invested in listed securities

|

|

Investment Period

|

3 to 10 Years

|

2 to 5 Years

|

1 to 10 Years

|

|

Maximum Number of Investors

|

1000 (200 for Angel Funds)

|

Not Stipulated

|

Not Stipulated

|

|

Restriction & Compliance

|

Moderate

|

LOW

|

HIGH

|

|

If QIB Permitted

|

Yes

If held for at least 1 year then no lock in prior to IPO

|

Yes

If held for at least 1 year then no lock in prior to IPO

|

YES

|

|

Leverage

|

NO

|

NO

|

2 times leverage or 100 percent of exposure is permitted

|

|

Investment by PFI, Insurance Companies & Banks

|

Permitted

(restricted to 10 % in Angel Funds)

|

Permitted

(restricted to 10 % in Angel Funds)

|

Not Permitted

|

|

Open Ended or Close Ended

|

Close Ended

|

Close Ended

|

Open or Close Ended

|

Category I AIF

Category I Alternative Investment Fund are the funds which invest in economically and socially viable early-stage StartUps, Small and Medium Enterprises and new businesses with unique products or services with high potential for growth. Several promotional and incentivizing initiatives have been taken by the government for such funds due to the growth prospect and employment creation fuelled by such funds. These funds have proved to be very helpful to the startup ecosystem in India.

Category I comprises the following types of funds:

âž² Venture Capital Fund (VCF)

Venture Capital Funds are Category I Alternative Investment Funds which provide funding to startups, early-stage venture capital projects or to a small or medium-sized business, to own a part of its equity.

VC’s generally prefer funding businesses, that are already established or that are in their growth stage & have a long-term potential to mitigate their risk of losing investments.

VC’s act as a pool which collects money from various investors who are willing to undertake equity investments in ventures. VC’s, in turn invest this money, in multiple prospective projects including start-ups and SME’s. Such investments are made considering a calculated risk after taking elaborate note of several factors linked to the growth of the projects they invest in.

Unlike any collective investment schemes or mutual funds or hedge funds, investors of a VC get a pro rata share of every business the VC has invested in.

High Net Worth Individual Investors, from India and abroad, who seek high risk-high return ratio highly prefer investing in Venture Capital Form of AIF, Thus, contributing towards the growth of our economy.

âž² Angel Fund [AF]

An “Angel Investor” refers to an individual who is willing to invest in and “ANGEL FUND”. Angel funds are pretty much similar to Venture Capital Funds. The primary difference between the two is what money they use to invest.

This kind of funds comprises of various “angel” investors who contribute to the pool of funds known as the “ANGEL FUND”. Such funds prefer to invest in early-stage or budding start-ups for their growth.

When and “Angel Investor” invests in such funds, they are issued units of such fund. Angel Funds have a comparatively higher risk-return ratio. The source of returns on investments by such funds are the dividends from the profits that their investee companies make once they achieve growth and profitability.

âž² Infrastructure Fund [IF]

Infrastructure funds invest specifically to invest in companies incorporated for the purpose of development of infrastructure projects. This kind of fund facilitates investment for investors who prefer to put money in infra development projects since the infrastructure sector has considerably high entry barriers and relatively lower levels of competition. Such funds also enjoy various tax benefits and subsidies from the government of India.

Investment in Infrastructure funds generally yields double-fold returns in the form of capital growth and dividend income.

âž² Social Venture Fund [SCF]

Social venture funds [SCF’s] are a result of the evolution of socially responsible investing in India. This type of AIF’s typically invests in companies which focus on making profits and solve environmental as well as social issues simultaneously. Despite the investments being benevolent in nature, the expectation of returns is not far-fetched as the investees would still make profits.

The target investment opportunities for SCF’s are typically the social welfare projects carried out of developing countries as they have great potential for growth as well as social change.

Social Venture Funds engage the latest technology, best managerial practices and huge resource pool towards the target project with an aim at carving out a win-win situation for all the stakeholders including investors, enterprises and society in general by investing in social and infrastructure projects.

âž² SME FUND

SME (small and medium enterprise) funds fall under the Category 1 SIF (Alternative Investment Funds) that prefer investing in listed/unlisted micro, small and medium enterprises.

SME sector is an impediment to the growth of an emerging economy. This Sector generally tends to meet their debt capital requirements through collateral-based lending offered by NBFC’s and other financial institutions. However, there has been a constantly increasing GAP between the demand and supply of debt capital to this sector. A substantial portion of the SME sector lacks collateral security required for collateral-based lending preferred by the Banks and NBFC’s. Also this sector fails to attract the risk investors like Venture funds, angels funds as SME’s don’t offer a high risk-return ratio. Thus, creating a vacuum for equity-based funding for such companies as equity funds are normally directed towards start-ups or established listed and unlisted companies with high return potential.

SME funds help bridge this gap of capital requirement faced by the SME sector by offering equity financing to these companies. SME FUNDS earn returns if the investee company reports substantial growth above minimum return (Say 8-10 %) or if the company gets listed on stock exchange attracting public investment(s).

Category II AIF

Category II Alternative Investment Funds are often done by elimination meaning that:

All those funds that are not described under category I and III AIF, fall under category II. Category II funds invest in various equity debt securities come and attract no incentives or concessions by the government. Such funds typically invest in unlisted private companies.

Funds resort to borrowing or leveraging funds for its underlying activities in accordance with the provisions laid down by SEBI. Some examples of Category II Alternative Investment Funds [CATEGORY II AIF] are Private Equity Funds [PE Funds], Real Estate Funds, Debt Funds and funds established for distressed assets.

Category 2 Alternative Investment Funds shall not engage in borrowing or leveraging activities except for temporary funding needs of up to 10 % of their investible funds for a period ranging from 30 to 365 days.

Category II comprises the following funds:

âž² Private Equity (PE) Fund

Private Equity funds is a Category 2 Alternative Investment Fund which basically normally invests in unlisted private companies against a share of their ownership. Unlisted private companies are not allowed to raise capital by issue of equity or debt instrument to the public. Hence, they turn towards PE funds to fulfil their funding requirements.

Further, PE Funds mitigate their risk by offering its investors with a diversified portfolio of equities managed by highly experienced fund managers. PE funds typically invest for a time period ranging between 4 to 7 years. Post the investment period, PE Funds expect to be able to exit the investment with a considerable profit.

âž² Debt Fund

Debt Fund are privately pooled funds established for primarily investing in debt instruments of listed as well as unlisted companies.

Debt Funds prefer investing in companies with high growth potential & good corporate practices going through a capital crunch as they can be a good investment option for debt fund investors. However, Companies with low credit score generally offer debt securities with a high yield but also accompany with high risk. So

As per the SEBI Regulations, the amount invested in Debt Fund cannot be utilised for the purpose of giving loans, as Alternative Investment Fund is a privately pooled investment vehicle.

âž² Fund of Funds

Fund of funds as the name suggests is a combination of various Alternative Investment Funds. Such funds don’t make their own portfolio or sector-specific investments. Fund of funds is established to invest in a portfolio comprising of other AIFs. Unlike the fund of funds in case of mutual funds, FUND OF FUNDS under AIF are not permitted to invite capital from the public or issue their units to publicly.

Category III AIF

Category 3 Alternative Investment Funds are funds which aim at short term returns. In order to achieve short-term capital appreciation, such funds engage various complex and diverse trading strategies. Government has offered no incentives or concessions for category 3 Alternative Investment Funds.

Category III Alternative Investment Funds may borrow or leverage funds subject to consent from its investors and to a maximum limit as may be prescribed by SEBI. Category III AIFs may invest in the units other AIF’s from category I, Category II or Category III AIFs. However, Category III AIFs cannot invest in the units of Fund of Funds.

Category III comprises the following funds:

âž² Hedge Fund

Hedge Funds are Category 3 Alternative Investment Funds which pool funds from institutional and accredited investors and invests in domestic as well as international markets by employing different strategies to earn alpha or active returns. Hedge Funds take up leverage & derivatives to a great extent and are aggressively managed with an aim of generating high returns on their pooled capital. Such funds are comparatively less regulated as compared to similar mutual funds and other investment vehicles.

It is to be noted that Hedge Funds are relatively expensive as compared to other financial investment instruments as they generally charge an asset management fee of 2% and collect a high fee up to 20% of the profits earned.

âž² Private Investment in Public Equity Fund (PIPE)

It is a privately managed pool of privately sourced funds reserved for investment in public equity. Private investment in public equity means buying the shares of publicly traded stock at discounted rates. This basically implies that the investor purchases a stake in the company, whereas the investee company receives a capital infusion for its business.

Read More on Decoding Category III AIFs: Structure, Leverage, and Regulatory Implications

What is the process for obtaining AIF registration?

Steps and Process for AIF Registering in India

Guide to setting up Alternative Investment Funds in India

Alternative Investment Funds (AIFs) registration have become increasingly common in India over the past decade, as an alternative investment choice for successful investment portfolio diversification. In addition, even smaller investors now have access to invest in AIFs through the SIP route of the mutual fund.

Following points would act as a guide for setting up an AIF in India:

1. Application to SEBI through Form A along with cover letter

The process of registration as an AIF in India starts with the application made to the SEBI by the AIF via Form A in the specified format. This application is a prerequisite for SEBI to grant the AIF a certificate of registration under the 2012 SEBI (Alternative Funds) Regulations. SEBI usually reverts to the AIF registration criteria within 21 days of making the submission, which may also be longer, depending on the pace of compliance adopted by the AIF. It is therefore important that AIFs do their homework on the eligibility requirements for AIF under the SEBI (Alternative Funds) Regulations, 2012well, before submitting An application in its form.

The AIF must write a cover letter addressed to SEBI stating explicitly whether it is already listed as a VC fund with SEBI. Should it already be registered, all related registration information must be given to SEBI. Furthermore, in the cover letter, the AIF must indicate to SEBI whether it had already commenced operations as an AIF well before the request had been made, in which case it must provide the relevant information to SEBI. In the event that the AIF demands the registration of a new fund, this must be clearly stated in its cover letter to SEBI.

2. Preparing a Bank Draft payable to SEBI

After AIF has filled out the form A and has drawn up its cover letter, it must obtain a bank draft for payment of the application fee in favour of SEBI of Rs 100,000, of which information can be added into the cover letter to SEBI.

3. Evaluation of application by SEBI

SEBI shall thoroughly review the application once it receives it in order to assess whether the AIF has met all the necessary requirements for eligibility set out in the SEBI Regulations. For SEBI, this is important for the granting of AIF registration. Upon the SEBI is completely pleased with all the criteria of its evaluation process, it shall approve the AIF application and notify the AIF applicant expressly of this.

4. Payment of registration fee to SEBI

If a letter from SEBI is received informing the AIF that its application is successful, it must prepare the AIF for payment of the Rs. 500,000 registration fee in order to obtain AIF status in India. A central notice is, however, that an AIF already registered in India as a VC fund with SEBI should only arrange to pay SEBI a fee of R. 100,000 for re-registration. SEBI will offer the candidate 'Certificate of Enrolment' as an Alternative Investment Fund in India upon receipt of relevant registration fees.

5. AIF must ensure strict compliance SEBI's reporting and other guidelines

The AIF shall sign the registration process at the end of the SEBI as well as the applicant once the AIF receives its Registration Certificate. However, AIF has to ensure that it meets all the main report specifications stated by SEBI in the sense of compulsory enforcement. In addition, the AIF shall be updated by its website and circulars on the SEBI guidelines communicated by SEBI. The AIF shall disclose, in a reasonable amount of time, any material changes in the original data given by the AIF to SEBI.

What are the different Categories of AIF?

FAQs for Alternative Investment Fund Registration

| 1 |

Q: Can you explain what an Alternative Investment Fund (AIF) is?

A: An AIF is a type of investment fund that is not typically covered by conventional investment regulations. These funds can invest in assets that are not part of the usual stock and bond markets, making them a diverse and potentially lucrative option for investors seeking different risk and return profiles. |

|

| 2 |

Q: How does an Alternative Investment Fund differentiate from conventional investment funds?

A: Unlike traditional funds, AIFs invest in alternative assets such as real estate, private equity, commodities, hedge funds, and derivatives contracts. These provide investors with more diverse portfolio options and can help reduce risk through better asset diversification. |

| 3 |

Q: Who should consider AIF registration services?

A: Asset managers, investment companies, and individual investors who want to invest in alternative assets should consider AIF registration. It provides the legal framework and regulatory compliance needed to operate such funds. |

| 4 |

Q: Could you describe the various categories of AIFs?

A: There are three categories: Category I for funds that invest in start-ups or social ventures, Category II for funds that do not require any incentives or concessions, and Category III for funds that aim to make short-term returns. |

| 5 |

Q: What is the procedure for registering an Alternative Investment Fund?

A: Registration involves applying to the Securities and Exchange Board of India (SEBI), along with the necessary documentation and fees. Corpzo can help streamline this process. |

| 6 |

Q: What documentation is necessary for AIF registration?

A: Documentation includes details of the fund's sponsors and managers, the fund's investment strategy, and risk management techniques. A detailed business plan and key investment team resumes are also necessary. |

| 7 |

Q: How long does AIF registration typically take?

A: The timeframe can vary, but it generally takes around 2-3 months after the submission of all necessary documentation. |

| 8 |

Q: Are there any limitations on who can invest in an Alternative Investment Fund?

A: Yes, AIFs are usually designed for accredited or institutional investors who meet certain income and net worth criteria. |

| 9 |

Q: Is an Alternative Investment Fund regulated, and if so, who regulates it?

A: Yes, AIFs in India are regulated by the Securities and Exchange Board of India (SEBI). |

| 10 |

Q: What are the advantages of AIF registration?

A: Registration allows the AIF to collect funds from investors legally, operate in compliance with SEBI regulations, and potentially give investors more confidence in the fund's legitimacy and management. |

| 11 |

Q: What are the potential risks associated with setting up and managing an AIF?

A: Risks include market volatility, liquidity issues, and regulatory compliance challenges. Corpzo can provide expert guidance to help mitigate these risks. |

| 12 |

Q: Can AIFs attract foreign investments?

A: Yes, AIFs can accept foreign investments as long as they comply with the regulations set forth by SEBI and RBI. |

| 13 |

Q: What are the minimum investment requirements for Alternative Investment Funds?

A: As per SEBI guidelines, the minimum investment in an AIF is Rs. 1 Crore. |

| 14 |

Q: How does Corpzo assist in AIF registration?

A: Corpzo provides end-to-end AIF registration services, including assistance with the application process, document preparation, and compliance with SEBI regulations. |

| 15 |

Q: Who can set up an AIF - an individual or a company?

A: Both individuals and companies can set up an AIF, provided they meet the regulatory requirements set by SEBI. |

| 16 |

Q: What are the ongoing reporting requirements for an AIF?

A: AIFs are required to submit regular reports to SEBI, including details of their financials, investments, and any material changes to the fund. |

| 17 |

Q: Can an AIF be transformed into another type of fund?

A: Generally, the transformation of an AIF into another type of fund would require compliance with a different set of regulations and possibly a new registration process. |

| 18 |

Q: Are there any specific sectors where AIFs cannot invest?

A: AIFs have a wide scope of investment; however, SEBI guidelines may restrict certain types of investments or sectors. |

| 19 |

Q: How are AIFs taxed?

A: Taxation of AIFs in India depends on the category of the fund and the nature of the income. Corpzo can provide detailed tax guidance for AIFs. |

| 20 |

Q: What are the responsibilities of an AIF manager?

A: The AIF manager is responsible for making investment decisions, managing risks, ensuring regulatory compliance, and maintaining transparent communication with investors. |

| 21 |

Q: How does an AIF benefit from SEBI's regulations?

A: SEBI's regulations ensure transparency, protect investor interests, and promote a healthy and competitive environment in the alternative investment market. |

| 22 |

Q: Is real estate investment possible through an AIF?

A: Yes, real estate is a common asset class for many AIFs, offering an alternative to traditional securities investment. |

| 23 |

Q: What are the reporting and disclosure requirements for AIFs?

A: AIFs are required to provide regular updates to SEBI and their investors, including financials, risk management strategies, and any significant changes to the fund. |

| 24 |

Q: Can Corpzo help with meeting the reporting and disclosure requirements of an AIF?

A: Yes, Corpzo provides comprehensive support for AIFs, including help with regular reporting and disclosure requirements. |

| 25 |

Q: What is the exit strategy for investors in an AIF?

A: The exit strategy depends on the terms of the fund and the nature of the investment. This can include a trade sale, IPO, or a secondary sale to another investor. |

| 26 |

Q: What are the Income Tax implications of a VCF?

A: Income of a VCF is taxable at the fund level in accordance with the current regime (except for the exemption provided under section 10(23 FA) of the Income Tax act. This exemption is for any dividend income or income by capital gains), and is also taxable in the hands of the investors when distributed by VCF to the investors. Pool, as well as investor-level taxation, has been applicable for decades according to the Indian Income Tax statutes for decades.

(reference: CLICK HERE)

A proviso added to section 10(23FB) of the Income Tax Act by the Finance Act 2015 stated that Category I and Category II AIFs that are registered under the AIF Act are not subject to the tax.

AIF Funds are taxed in accordance with the latest amendments outlined in the ITA's newly adopted Chapter XII-FB. This meant that VCFs that were previously registered under the VCF Regulations would be able to take the benefits of exemption under section 10(23FB) for the incomes arising out of venture capital undertaking investments.

The Income Act also provides that taxes charged under the heading "Profits and gains from business and profession" will be taxed at the Alternative Investment fund level, with no tax duty passing through to unit holders, which is also known as the TAX PASS THROUGH STATUS. To give effect to this, the Act has two provisions:

a. Section 10(23FBA), which provides exemption from the income of an investment fund that is not chargeable under the heading "Profits and gains of business or profession"; and

b. Section 10(23FBB) provides exemption from the income accruing or arising to, or received by, a unit-holder of an investment fund that is of the same nature as income chargeable under the heading "Profits and gains of business or profession." |

|

| 27 |

Q: What are the indirect tax implications applicable to Alternative Investment Funds and Alternative Investment Fund Managers in India?

A: AIF located in India is considered to be a distinct artificial. Any services (from Fund Manager or any other service provider) which is availed by the AIF are subject to 18% GST. AND, as AIF is only a pooling vehicle and does not provide any service at all, hence, it has no output GST liability. Hence, the AIF is not able to avail any ITC (input tax credit) and, in effect, the GST paid on its expenses is a sunk cost and forms part of the expenditures of the fund. Such GST is effectively borne by the investors of the AIF. This is also true for GST on fund management fee earned by the Fund manager, which is one of the most significant expenses incurred by an AIF in its course of business. |

| 28 |

Q: Are AIF Open Ended or Closed Ended?

A: Category I and II AIF (Alternative Investment Funds) are close-ended funds with a minimum tenure of three years as prescribed by SEBI AIF Regulations. However, Category III AIFs have the option to be open-ended funds. A Category III AIF, being an open-ended fund, would simply mean that an investor can subscribe to it anytime during the tenure of the fund. |

| 29 |

What is the Minimum Corpus Requirement for AIF Registration?

A: The growth of Alternative Investment Funds (AIFs) in India has opened new avenues for investors seeking high-yield opportunities beyond traditional financial products. However, before launching an AIF, it’s crucial to understand the minimum corpus requirement, a key eligibility criterion set by the Securities and Exchange Board of India (SEBI).

As per the SEBI (Alternative Investment Funds) Regulations, 2012, each AIF scheme must have a minimum corpus of ₹20 crore. This means that the total commitment from all investors in a particular scheme cannot be less than ₹20 crore. In the case of an Angel Fund, which operates under Category I AIF, the minimum corpus requirement is ₹10 crore.

Additionally, SEBI mandates that every investor in an AIF must commit at least ₹1 crore to the fund. However, employees or directors of the AIF, as well as those of the fund manager, are allowed to invest a lower minimum amount of ₹25 lakh. This ensures that only informed and capable investors participate in such complex and high-risk investment structures.

The minimum corpus rule is designed to ensure financial stability, investor protection, and regulatory discipline. It prevents undercapitalized funds from entering the market and promotes confidence among investors that the fund has sufficient resources to operate effectively.

Understanding and meeting these financial thresholds is critical for fund managers or promoters planning to establish an AIF in India. Proper compliance not only speeds up the SEBI registration process but also enhances the fund’s credibility in the eyes of institutional and high-net-worth investors.

|

| |

How Long Does It Take to Get AIF Registration in India?

A:

Setting up an Alternative Investment Fund (AIF) in India is a strategic move for investors and fund managers who wish to explore high-value, non-traditional investment opportunities. However, one of the most common questions among applicants is — how much time does it take to obtain AIF registration from SEBI?

The Securities and Exchange Board of India (SEBI) regulates the registration process under the SEBI (Alternative Investment Funds) Regulations, 2012. On average, the approval timeline for AIF registration is 6 to 8 weeks, but the duration can vary depending on several factors, such as documentation accuracy, fund structure, and response time to SEBI’s queries.

The process begins with the preparation of essential documents, including the placement memorandum, fund structure details, and compliance declarations. Once the application is submitted online through SEBI’s intermediary portal along with Form A and the prescribed fee, SEBI reviews the application thoroughly. If the regulator requires clarifications or additional information, the applicant must respond promptly to avoid delays.

Once SEBI is satisfied with the documentation and fund compliance, it issues the Certificate of Registration, officially recognizing the entity as an Alternative Investment Fund in India.

While the standard timeline is around two months, applicants who ensure complete, accurate, and well-structured submissions often receive approval faster. Engaging professional advisors or consultants experienced in AIF registration can also streamline the process and reduce the likelihood of rejections or queries.

In conclusion, timely preparation, transparency, and expert guidance play a vital role in obtaining AIF registration efficiently — paving the way for a compliant and successful investment fund operation in India.

|

Who is an accredited investor?

Accredited investor

As per the AIF Regulations (Third Amendment), "Accredited Investors," means ‘any person who is granted a certificate of accreditation by an Accreditation Agency, subject to the eligibility parameters prescribed by SEBI’. In addition to the investors who qualify for accreditation by meeting the prescribed thresholds, the Third Amendment includes a list of individuals who are deemed to be Accredited Investors without having to undertake the accreditation process.

The Third Amendment establishes specific criteria for an investor to qualify as an “Accredited Investor” and avail benefits of relaxations granted to such investors

The logic for introducing the concept is to recognise a class of investors who are well-experienced in investment risks and have the knowledge as well as financial capacity to take the risk.

What is the eligibility of and Accredited investor?

-

|

Individual, Hindu Undivided Family, family trust or sole proprietorship satisfying any of the following conditions:

|

-

|

Annual Income at least INR 2,00,00,000 (Indian Rupees Two crores); OR

|

-

|

Minimum Net Worth of INR 7,50,00,000 (Indian Rupees Seven crores and Fifty lakhs),

out of which not less than 50% (i.e., INR 3,75,00,000 (Indian Rupees Three crores and Seventy Five lakhs) is in the form of financial assets; OR

|

-

|

Annual Income of at least INR 1,00,00,000 (Indian Rupees One crores) and

Net worth of at least INR 5,00,00,000 (Indian Rupees Five crores), at least half of which (i.e., INR 2,50,00,000 (Indian Rupees Two crores and Fifty lakhs) is in the form of financial assets;

|

-

|

body corporate having a minimum net worth of INR 50,00,00,000 (Indian Rupees Fifty crores);

|

-

|

trust (other than family trust) having a minimum net worth of INR 50,00,00,000 (Indian Rupees Fifty crores); and

|

-

|

partnership firm (incorporated under the Indian Partnership Act, 1932, each partner must independently meet the applicable eligibility criteria (detailed above) for accreditation, depending on their form.

|

Deemed Accredited Investors

Furthermore, government, developmental, or fund entities of the Centre and States, qualified institutional buyers under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018, Category I foreign portfolio investors, sovereign wealth funds, and multilateral agencies, and other entities notified by the SEBI shall be deemed Accredited Investors, with no requirement to obtain an accreditation certificate.

While the February Consultation Paper mentioned a separate set of thresholds for non-resident Indians (NRIs) and foreign entities, the Third Amendment makes no distinction between the criteria for residents and NRIs / foreign entities. It remains to be seen how the Accreditation Agencies apply the eligibility conditions imposed on entities and individuals located outside of India.

Relaxation in minimum investment value

The AIF Regulations have been amended to exempt Accredited Investors from investing a minimum of INR 1,000,000 (Indian Rupees One Crore), which is a welcome change.

In line with the notion that Accredited Investors are sophisticated investors who require less regulatory protection, the minimum investment threshold for investing in AIFs has been eliminated for such Accredited Investors, giving them greater flexibility in structuring their investments.

How is an AIF taxed in India?

Taxation of Alternative Investment Funds (AIFs) in India

Understanding the tax implications of investing in Alternative Investment Funds (AIFs) is crucial for investors looking to maximise their returns. In India, the taxation of AIFs can be somewhat complex, primarily due to the various categories that these funds fall under. The Income Tax Act, 1961 provides a specific tax regime applicable to AIFs.

Types of AIFs and Tax Implications

AIFs in India are classified into three categories:

-

Category I AIFs: These include funds that invest in start-up or early-stage ventures, social ventures, small and medium enterprises (SMEs), infrastructure or other sectors which the government or regulators consider socially or economically beneficial for the country. The income of Category I AIFs is exempt from tax, but investors are taxed on their share of income from the AIF.

-

Category II AIFs: This category encompasses funds that do not fall under Category I and III and do not undertake leverage or borrowing other than to meet day-to-day operational requirements. Similar to Category I, the income of Category II AIFs is also exempt from tax, with the tax liability falling on the investors.

-

Category III AIFs: These are funds that employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives. In this case, the tax treatment varies. Short-term capital gains are taxed at 30%, and long-term capital gains are taxed at 10% without indexation and 20% with indexation.

Pass-Through Status of AIFs

The taxation of AIFs in India also depends on whether the fund has a 'pass-through' status. This means the income is taxed in the hands of the investor, not at the level of the AIF. Category I and II AIFs enjoy this status for all types of income. However, for Category III AIFs, only income by way of capital gains gets the pass-through benefit.

Tax Deducted at Source (TDS)

The regulations also mandate that any income (other than in the nature of capital gains) paid by AIFs to their investors is subject to Tax Deducted at Source (TDS) at the rate of 10%.

Indirect Transfer Provisions

In some cases, if the shares of a foreign entity derive substantial value from assets located in India, a transfer of these shares could be taxable in India. This is known as the indirect transfer provision, and it may affect foreign investors in AIFs.