Alternative Investment Fund (AIF) Registration:

Gujarat International Fin-Tec City (GIFT City) is being built as a worldwide financial and IT services hub, similar to globally benchmarked financial centres. It features an International Finance Services Centre ("IFSC")-designated Special Economic Zone. The IFSC was established to handle financial services transactions now carried out outside of India by foreign financial institutions and Indian financial institutions' overseas branches and subsidiaries.

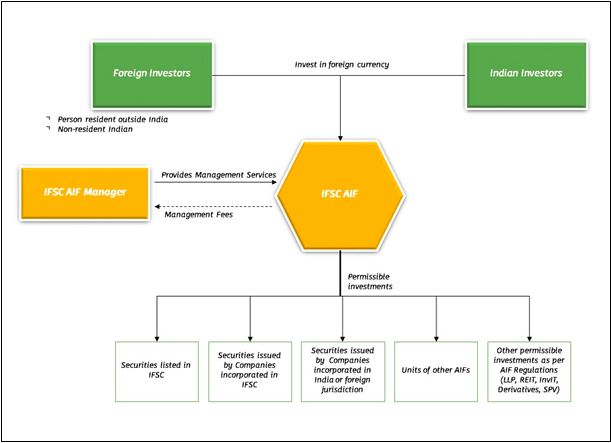

The regulatory framework controlling funds in the IFSC has undergone significant regulatory modifications as part of the broader regulatory effort to support the expansion of financial services intermediaries in the IFSC. As a result, the IFSC is quickly establishing itself as a viable alternative to well-known fund jurisdictions like Singapore and Mauritius.

FAQs

1. What is an International Financial Services Company (IFSC)?

Under the Special Economic Zones Act of 2005, the Central Government established a framework for the establishment of an IFSC. The IFSC was created to allow financial service companies to offer foreign currency financial services and products to their consumers (i.e., non-INR currencies).

For India's exchange control regulations, "units" and "entities" in an IFSC are considered as "persons resident outside India."

In Gandhinagar, Gujarat, GIFT City is being created as a worldwide financial and IT services hub to compete with globally benchmarked financial centres. It was designated as a Special Economic Zone ("SEZ") and is India's only certified IFSC. Because of its unique position, the IFSC is a desirable jurisdiction for pooling and managing global money.

2. Can Alternative Investment Funds be established in the IFSC?

Yes, all three types of Alternative Investment Funds (“AIFs”) (Category I, Category II, and Category III), as well as funds of funds, can be established in an IFSC.

The SEBI (Alternative Investment Funds) Regulations, 2012 (“AIF Regulations”) also apply to AIFs in the IFSC. AIFs in IFSCs, on the other hand, have been granted specific dispensations to provide them with greater operational freedom while preserving tax efficiency. Please see Query [8] for more information on the tax advantages of establishing funds in an IFSC.

3. Are there any requirements for GIFT AIFs in terms of minimum fund size, minimum commitment size, sponsor commitment, and so on?

The Securities and Exchange Board of India ("SEBI") published Operating Guidelines for Alternative Investment Funds in International Financial Services Centres on November 26, 2018 ("Operating Guidelines"), which stipulate the following requirements for AIFs in IFSCs:

- a continuous, minimum sponsor commitment of the lowest of:

- USD 0.75 million, or 2.5 percent of the fund's corpus for Category I and II AIFs;

- USD 1.5 million, or 5% of the fund's corpus for Category III AIFs;

- a minimum scheme size of at least USD 3 million;

- minimum investment

(a) by investors – USD 150 thousand; and

(b) by employees/directors of the AIF's manager – USD 40 thousand.

4. Does the regulatory framework established by SEBI for the formation of AIFs also apply to AIFs incorporated in GIFT City?

SEBI, India's capital markets regulator, which oversees AIF structures, has established special rules and restrictions for AIF formation in GIFT City. The Foreign Exchange Management (IFSC) Regulations, 2015, and the SEBI (IFSC) Guidelines, 2015, read with the Operating Guidelines, are the primary sources of regulation for AIFs in an IFSC. A fund must get registration from the IFSC Authority to operate as an AIF (as set up under the IFSC Authority Act, 2019).

5. Is it necessary for fund managers to establish a presence in the IFSC? What options do fund managers have in this situation?

IFSC AIF fund management entities can be established as a branch of an existing entity or as a separate entity in the IFSC. Notably, only existing fund managers have the option of establishing a branch office. Managers who want to raise a fund in an IFSC for the first time must first create an entity in that IFSC that will be responsible for the management of that AIF in that IFSC.

Because the status of entities in IFSCs is that of a person resident outside India, and given the nature of fund management activity, the process of forming a new company or LLP in GIFT City would be governed by Regulation 7 of the Foreign Exchange Management (Transfer or Issue of Any Foreign Security) Regulations, 2004 (“ODI Regulations”). Regulation 7 allows an Indian party engaged in the financial services sector to establish an overseas joint venture or subsidiary subject to certain conditions, including obtaining regulatory NOCs from the relevant financial services regulators in India and abroad.

6. What are the other options for committing sponsors to IFSC AIFs?

The RBI recently clarified that an Indian party will be permitted to make sponsor commitments to an AIF in IFSC, as required by the SEBI AIF Regulations, if the ODI Regulations are met.

A non-resident person or an entity in the IFSC can also make a sponsor commitment. A branch in the IFSC, for example, would need regulatory approval before making a sponsor commitment to an IFSC AIF.

7. What is the process for establishing AIFs in GIFT City?

The diagram below depicts the key steps (along with a rough timeline) involved in establishing an AIF in GIFT City.

8. What are the main tax advantages of forming AIFs in the IFSC, GIFT City?

From a tax standpoint, IFSC provides appealing tax benefits such as a 100 percent tax exemption on business income for 10 consecutive years out of 15 years (“Tax Holiday”) and GST exemption for IFSC entities. AIF managers can take advantage of these benefits in relation to their fund management income.

The tax pass-through status under Section 115UB of the Income Tax Act of 1961 has been extended to Category I and II AIFs. Meeting the ‘specified fund' criteria of a lower rate of taxation for income in the form of capital gains and interest applies to Category III AIFs. Furthermore, as previously stated, Category III AIFs with business income should be able to claim the Tax Holiday.

For the transfer of specific securities[1], a 100 percent tax exemption has been granted to Category III AIFs in the IFSC where (a) the consideration for the transfer is payable in a foreign currency; and (b) all units of the AIF are held by non-residents (except those held by the sponsor and/or manager of the AIF).

The following are the rates that apply to various types of income earned by a Category I or Category II AIF in the IFSC:

|

Revenue/Income

|

The tax rate for non-residents

|

Tax Rate for residents

|

|

WHT at AIF Level

|

At a rate below

|

10% (the rest of the tax is recovered from the investor at the rate mentioned below)

|

|

Investors Taxability

|

|

Dividend

|

20%

|

30%

|

|

STCG on which STT (securities transaction tax) has been paid

|

15%

|

15%

|

|

Other STCG (Short-term Capital Gain)

|

40% offshore Companies

30% offshore LLPs/firms

|

30%

|

|

LTCG (long-term capital Gain)

|

10% for gains from transfer of listed securities, where STT is paid as well as if STT is not paid;

10% for transfer of unlisted securities (without indexation);

20% for other long-term capital gains

|

10% for gains from the transfer of listed securities where STT is paid;

10% for gains from transfer of listed securities/20% (with indexation) if STT is not paid;

20% for transfer of unlisted securities (with indexation);

20% for Other long-term capital gains

|

|

Business Income

|

Notwithstanding the above, in case the income of the IFSC AIF is characterized as business income, the same shall be taxable in the hands of the IFSC AIF at a rate of 30% and any distribution of such income should be exempt from tax in the hands of the investors of the IFSC AIF.

The IFSC AIF may claim a tax holiday under section 80LA of the ITA with respect to its business income, subject to conditions. This tax holiday can be availed for a period of 10 consecutive years out of the first 15 years.

|

Category II AIF in IFSC taxable rates

|

Nature is Income

|

Rate

|

|

Dividend

|

10%

|

|

Long Term Capital Gain (112A –STT Paid)(on 100000 and above income)

|

10%

|

|

LTCG(Other Than 112A-STT Paid)

|

10%

|

|

STCG (STT Paid)

|

15%

|

|

Other STCG (not covered in 111A)

|

30%

|

|

WHT at the AIF level

|

0%

|

|

Investors taxability

|

Exempted

|

9. Are there any tax advantages available to non-resident investors who participate in IFSC AIFs?

Non-resident investors who purchase units in an IFSC AIF are not obliged to get a PAN or submit income tax returns in India if they do not have any other taxable income from their activities or interests in India.

Furthermore, revenue accruing to or received by non-resident investors from a GIFT City AIF's overseas assets should not be taxed in India.

10. Can IFSC AIFs use the FDI, FPI, and FVCI investment channels to invest in India?

Yes, IFSC firms have access to all three investment channels in India. This flexibility under foreign exchange laws complements AIF Regulations well, making the IFSC platform appealing to a wide range of funds, including angel funds, venture capital funds, private equity funds, infrastructure funds, credit funds, real estate funds, hedge funds, and so on. An IFSC AIF might submit an application to the IFSC Authority for registration as an FPI or FVCI.

11. Is it permissible for AIFs in GIFT City to invest in foreign companies?

Yes, because AIFs established in an IFSC are considered non-resident Indians under India's current foreign exchange regulations, they can engage in international firms without obtaining extra regulatory licences.

12. Are there any non-tax benefits available to AIFs in GIFT City, such as increased operational and structural flexibility?

The IFSC Authority, in a circular dated December 9, 2020, granted the following exemptions to IFSC AIFs:

I take on indebtedness without limitations, subject to investor disclosures and consent, as well as risk reduction from leverage;

(ii) Establish distinct unit classes for co-investing alongside the AIF in portfolio businesses with segregated portfolios, subject to investor disclosures, provided that the co-investments are not on more favourable terms than the AIF;

(iii) Invest up to 100% of its funds in a single investee business, as opposed to the concentration restrictions imposed on non-IFSC AIFs; and (iv) invest up to 100% of its funds in a single investee company, as opposed to the concentration limits imposed on non-IFSC AIFs.

(iv) Invest up to 100% of their investible funds outside of India in securities of foreign businesses, as opposed to the restrictions placed on non-IFSC AIFs.

The aforementioned exemptions provide AIFs with greater operational and structural freedom, putting them on par with offshore funds.

13. What are the most important factors to consider when GIFT City AIFs are fundraising? Is it legal for Indian residents to invest in GIFT City AIFs in order to make international investments?

Persons residing in India who have a net worth of at least USD 1 million in the previous financial year are eligible to participate in GIFT City AIFs, subject to the RBI's Liberalized Remittance Scheme restrictions (which is currently USD 250,000). AIFs, for example, can only invest funds obtained from residents in foreign investee firms or schemes.

Furthermore, funds that raise cash from Indian citizens should make sure that investments are done in a way that does not result in "round trippin." Of funds in India.

14. Will the IFSC AIFs be subject to any more regulatory changes in the near future?

Protected cell companies, multi-share class vehicles, and variable capital companies ("VCCs") are recommended corporate forms for putting up funds in most major global financial jurisdictions. Such arrangements can make distributions from the fund entity's capital without being bound by the limits on capital redemption and reduction that are prevalent in incorporation structures.

While the AIF Regulations in India allow AIFs to be formed as corporations and partnerships, the vast majority of AIFs formed in India are structured as trusts. A trust structure is not subject to solvency tests or limits on capital redemption or decrease, in addition to being very simple to set up and operate.

By Order dated September 22, 2020, the IFSC Authority established an Expert Committee (“Committee”) to assess the relevance and applicability of VCCs in the IFSC. VCCs were first launched in Singapore a few years ago, and the Monetary Authority of Singapore's pilot project drew a lot of interest from industry participants, with over a hundred VCCs already registered by 2020.

The Committee has issued a thorough report suggesting a wide framework for the VCC structure's implementation in the IFSC, including guidelines for VCC/sub-fund formation, capital funding, corporate governance, and so on.

VCCs, once enacted into law, would give the possibility of establishing IFSC AIFs in a globally recognised legal structure, giving the worldwide LP[7] community more comfort.

The following are the essential characteristics of VCCs as recommended by the Committee:

(i) The VCC's share capital should be a variable one. In other words, it should be able to accommodate frequent shareholder admission and leave without requiring extensive regulatory filings and approval.

(ii) The VCC can be set up as a stand-alone investment vehicle or as an umbrella fund with sub-funds that hold segregated portfolios. For each sub-fund inside the VCC, the VCC must issue a distinct class or classes of shares.

iii) A VCC's sub-fund should not be a different legal entity from the VCC.

(iv) To address the primary risk of cross-selling contagion, namely, preventing the assets of one sub-fund from being used for/set off against the liabilities of another sub-fund, asset and liability segregation requirements should take precedence over all other VCC requirements. All contracts entered into by the VCC must include a clause limiting any contractual claim against the relevant counterparty to the assets of the sub-fund alone.

(v) Each sub-fund of a VCC shall be considered as a distinct entity for tax purposes, having its own PAN. Furthermore, the sub-funds may be considered as separate companies for insolvency proceedings.

(vi) A VCC might contain a mix of open and closed-ended funds, with the option to switch from open to closed-ended and vice versa.